🚨 Did You Know? 1 in 4 Aussie Workers Experience Wage Theft

Imagine filling up your car with petrol, but the pump secretly skips every 5th litre—you’re paying for fuel you never get. That’s exactly what wage theft does: it steals your time and labor without you realizing.

For employees, contractors, and small business owners, spotting wage theft early could mean thousands in recovered wages—or avoiding crippling fines. This guide reveals 15 sneaky tactics employers use and exactly how to fight back.

🔍 Wage Theft Explained: The "Shrinkflation" of Your Paycheck

Think of wage theft like shrinkflation in supermarkets:

Your chips bag looks the same... but holds 15% less

Your paycheck seems correct... but missing hours, penalties, or super

The difference? While shrinkflation is legal, wage theft isn’t. Here’s how to spot it:

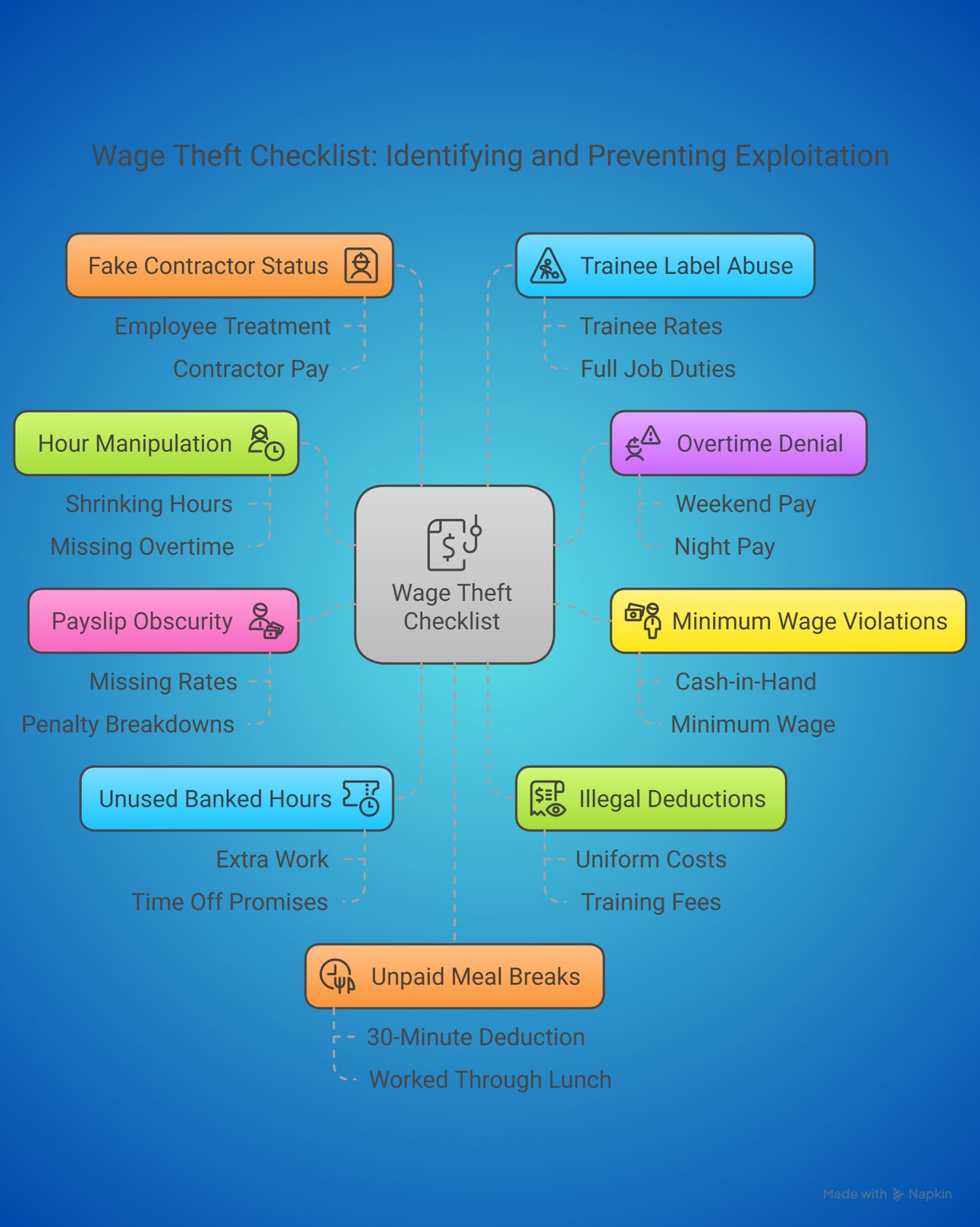

📜 The 15-Point Wage Theft Checklist

💰 Payment Red Flags

"Mysteriously shrinking hours"

Your recorded hours never match what you worked

Example: Clocking out at 5:30 PM but payslip shows 5:00 PM

The "disappearing overtime" trick

No extra pay for weekends/nights despite your award requiring it

Cash-in-hand below minimum wage

"We'll pay 20cash—notax!"(But minimum wage is 20 cash—no tax!"(But minimum wage is 23.23/hr)

📝 Documentation Warning Signs

Payslips that look like hieroglyphics

Missing hourly rates, penalty breakdowns, or super details

"Banked hours" that never get used

"Work extra now, take time off later" (Spoiler: Later never comes)

Illegal deductions

Money taken for uniforms, training, or "register shortages"

👥 Employment Status Scams

The "fake contractor" con

Treated like an employee but paid as a contractor (no super/sick leave)

"Trainee" labels for skilled work

Paid trainee rates despite doing full job duties

⏰ Time Theft Tactics

Automatic unpaid "meal breaks"

Deducting 30 minutes when you worked through lunch

Pre-shift work demands

"Just set up before clocking in—it only takes 10 minutes!" (Every day = 43 unpaid hours/year)

💼 Workplace Culture Red Flags

Retaliation threats

"If you complain about pay, don’t expect more shifts"

"We’re family" excuses

"Times are tough—pitch in without overtime pay"

🧾 Final Paycheck Games

Withheld termination pay

"You left suddenly—we’ll pay you when we can"

"Lost" leave entitlements

Annual/sick leave disappears when you quit

Ghosted super payments

Super fund hasn’t received payments in months

⚖️ Your 3-Step Action Plan

1. Play Detective

Compare payslips to the Fair Work Pay Calculator

Secretly document shifts (photos of rosters, screenshots of clock-in apps)

2. The Paper Trail Test

Send this email:

"Hi [Manager], my payslip shows [X hours] on [date], but I worked [Y hours]. Could you clarify?"

3. Nuclear Option

Report anonymously to the Fair Work Ombudsman—they’ve recovered $1 billion for workers since 2020.

💡 Why This Matters

Employees: You could be owed thousands in back pay

Employers: Accidentally underpaying? Self-report now to avoid jail time (yes, really—14 years in QLD)

📌 Bookmark this list—your future self might thank you.

Share this guide to help others spot wage theft!

Disclaimer: This content is general advice. For legal guidance, consult the Fair Work Ombudsman or an employment lawyer.