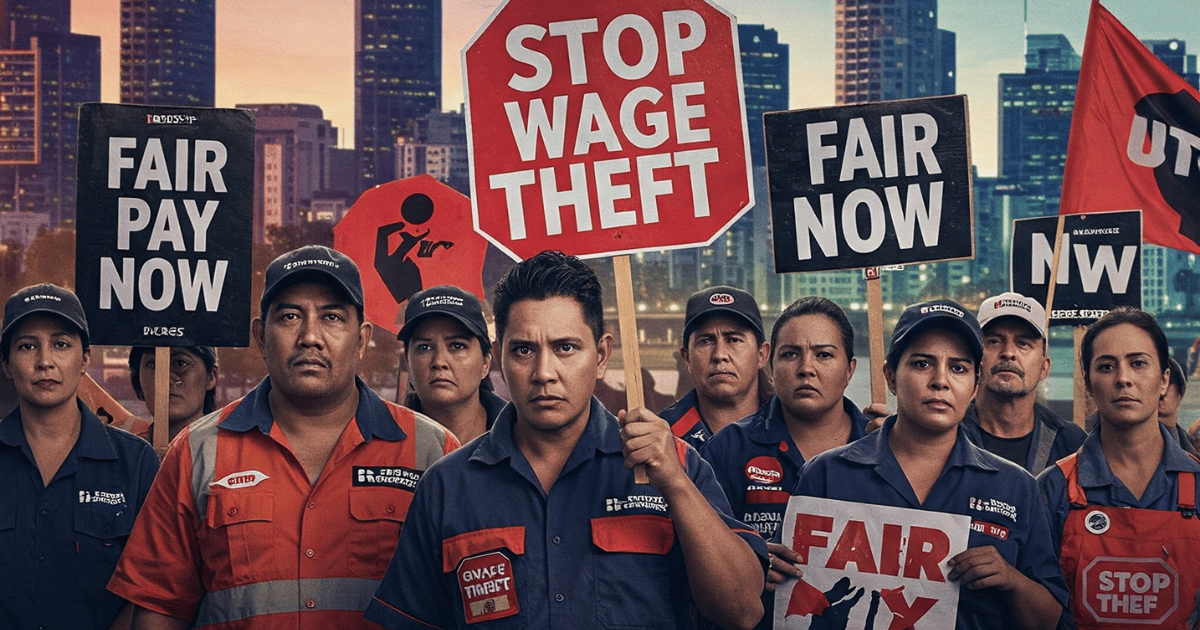

Wage theft has emerged as one of Australia’s most pressing workplace issues, costing workers hundreds of millions annually. From high-profile corporate scandals to systemic underpayments in hospitality and retail, the problem spans industries and impacts vulnerable workers disproportionately.

This comprehensive guide provides an authoritative overview of wage theft in Australia, covering:

✔️ What wage theft is (with real-world examples)

✔️ Current laws and penalties (federal and state breakdown)

✔️ How to identify and report underpayments

✔️ Major cases exposing systemic failures

✔️ Recent legal reforms and future outlook

Whether you're an employee suspecting underpayment, an employer ensuring compliance, or simply seeking to understand this complex issue, this guide serves as your definitive resource.

1. Understanding Wage Theft

Definition

Wage theft occurs when employers deliberately or negligently withhold rightful wages from employees. Unlike simple payroll errors, it often involves systemic underpayment or exploitation of vulnerable workers.

Wage Theft common types

Why It Matters

Economic impact: Estimated $1.35 billion stolen annually from workers

Social impact: Disproportionately affects migrants, students, and casual workers

Legal consequences: From fines to criminal charges (in some states)

2. Wage Theft Laws in Australia

Federal Framework

The Fair Work Act 2009 is the primary legislation governing wages nationally:

Maximum penalties: Up to $1.56 million for corporations

Enforcement: Fair Work Ombudsman (FWO) investigates complaints

State-Based Criminalization

Several states have introduced harsher penalties:

State wise paneities for wage theft

Key difference: While federal laws focus on financial penalties, states like Victoria treat wage theft as a criminal offence.

3. How Wage Theft Happens: Real Cases

Case Study 1: Woolworths ($390M Underpayment)

What happened: 6,000+ salaried staff underpaid due to incorrect classification

Outcome: Back payments + $1.2M in court-ordered penalties

Case Study 2: George Calombaris (MasterChef)

Industry: Hospitality

Underpayment: $7.8 million to 515 workers

Result: Public scandal led to restaurant group collapse

Emerging Trends

Universities: Casual staff underpaid for marking (NTEU report found $83M in underpayments)

Franchises: Systemic issues in fast food/retail chains

Red Flags You’re Being Underpaid

🔴 Payslips missing details (hours, rates)

🔴 Regular unpaid overtime

🔴 Being paid "cash in hand" below minimum wage

Steps to Take

Check your entitlements using the Fair Work Ombudsman Pay Calculator

Raise the issue with your employer (in writing)

Report to FWO if unresolved (anonymous options available)

Pro tip: Keep diaries of hours worked and all pay slips as evidence.

5. The Future of Wage Theft in Australia

Upcoming Reforms

Federal criminal penalties: Proposed laws mirroring Victoria/QLD

Stronger protections for gig workers: Addressing loopholes in "contractor" models

What Employers Should Do

✔ Conduct payroll audits

✔ Train HR teams on award compliance

✔ Implement whistleblower protections

Conclusion & Key Takeaways

✅ Wage theft is widespread – from cafes to corporate giants

✅ Laws are tightening, with jail time now possible in some states

✅ Employees have rights – document everything and report underpayments

✅ Employers must prioritize compliance to avoid massive penalties

Need Help?

Employees: Contact the Fair Work Ombudsman

Employers: Seek workplace law advice

Explore More

For deeper dives into specific aspects of wage theft, see our dedicated articles on:

How to Prove Wage Theft

State-by-State Wage Theft Laws

High-Profile Wage Theft Cases